The Madness Is Only Compounding: Ignore The Herd

The collective madness of crowds is a powerful force and can drive a group of individuals to behaviors and actions that normally wouldn’t be seen on an individual level. Once the madness takes over, it spares no one – rich, poor, old, young, male, female, etc. And those who dare question the crowd are often shouted down or shamed into silence.

As humans, we have primitive instincts that can be brought out in group situations that make us do things as a group we wouldn’t do as individuals.

“One dog may bark at you, but it’s more likely that a pack will attack you.” -Dr. Wendy James, The Psychology of Mob Mentality and Violence.

People lose control of their usual inhibitions when their mentality becomes that of the group.

In the past two years, we have seen the madness of the crowds on full display in the world of finance. Armed with stimulus money, investors have been seen throwing caution to the wind and investing irrationally in anything and everything with no thought of underlying economic fundamentals.

Meme stocks are one example where investors snatched up stocks of companies that were worthless on paper (i.e., companies like Hertz, who filed for bankruptcy) solely based on internet and social media hype.

Crypto is another example, with investors from all walks of life hopping on the bandwagon. Fueled by heavyweight endorsements by tech titans like Elon Musk and by celebrities like Tom Brady and Matt Damon, crypto raced to new highs in 2021. Even Dogecoin, a cryptocurrency that started as a practical joke, gained heavy attention.

Crowd behavior was in full force as the internet and social media drove the stock market and cryptocurrencies to new highs in 2021. “The sky was the limit,” shouted many talking heads. Critics and naysayers who dared sound the alarms were shouted down and criticized as ignorant or dangerous. Fast forward to today, and it’s a whole different story. The investors who refused to jump on the hype train are the ones who have avoided massive losses.

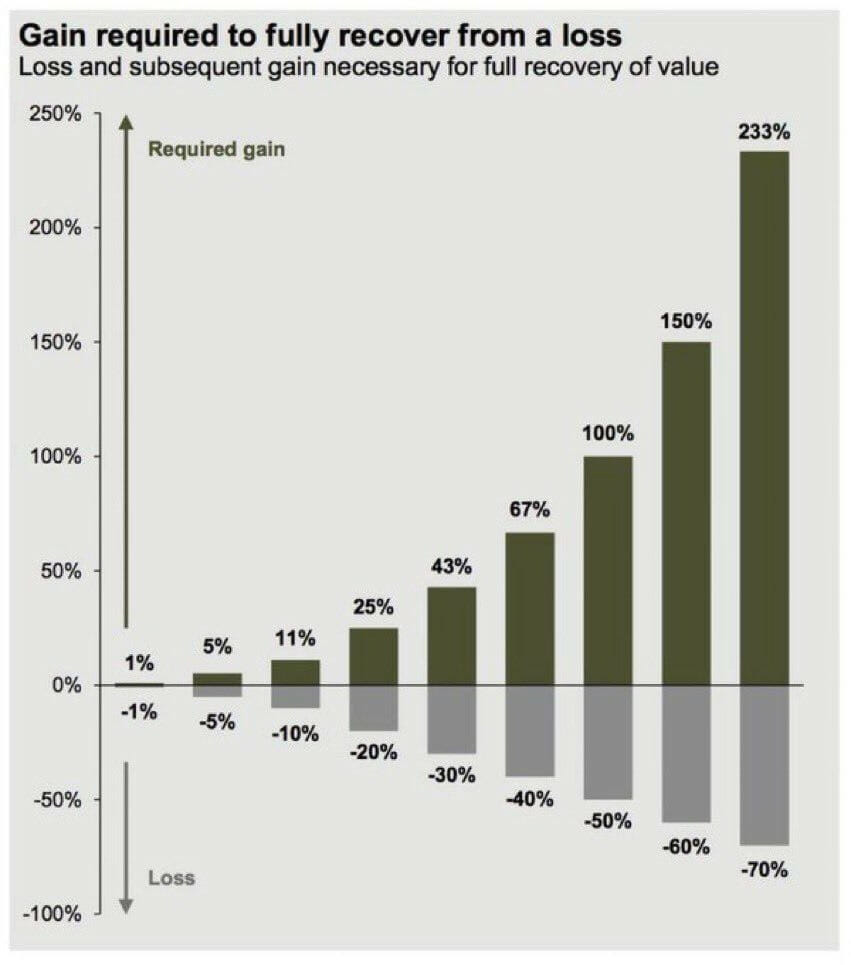

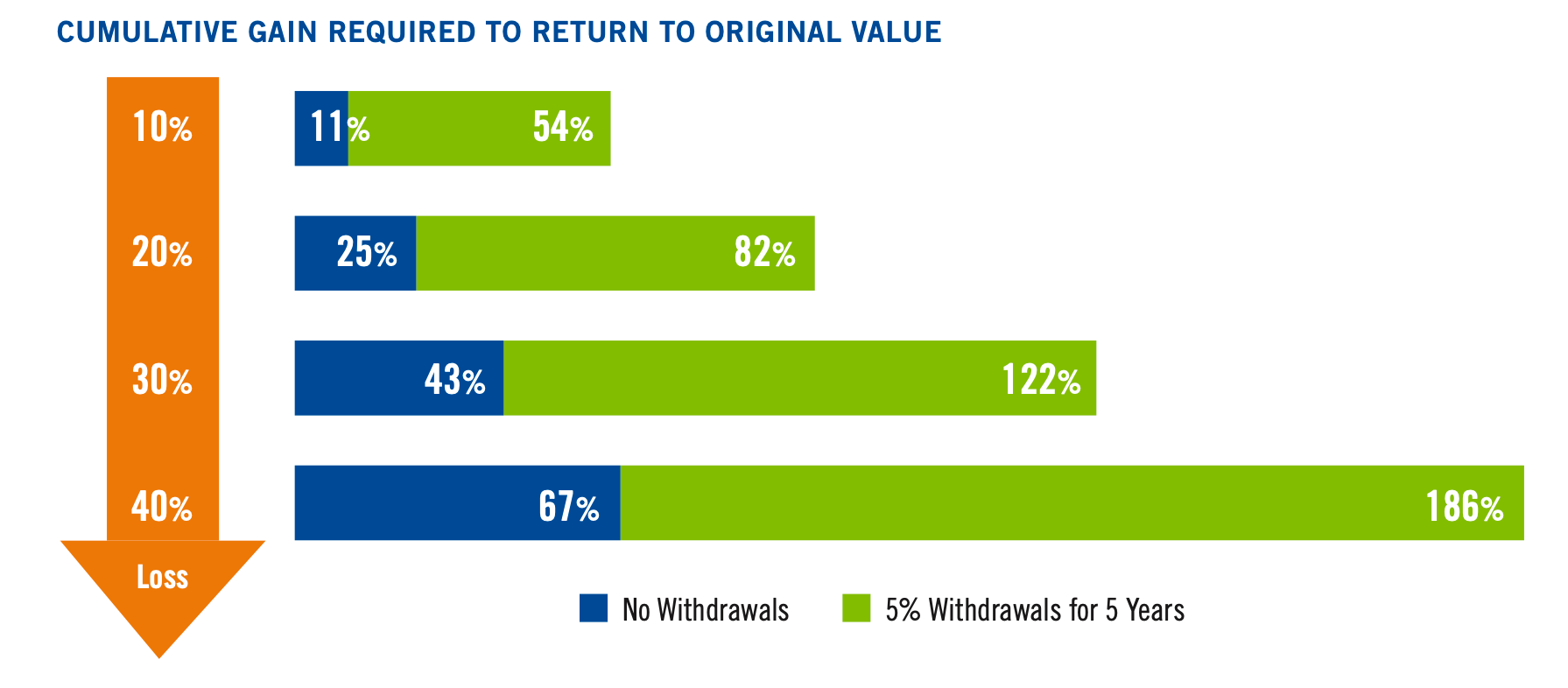

Since reaching record highs last November, the stock and crypto markets have crashed. In the one year since that time, Bitcoin is down 75%, and not counting the most recent post-election bump, the Dow was down more than 22% right before the election. As history has taught us, investors should expect that post-election bump to wear off soon.

The past year has been another lesson in avoiding the madness of the crowds. It’s just another example of when investors talked themselves into going along with the group because nobody thought the investment could fail. It’s the same thing investors thought about dotcoms and subprime mortgage-backed securities back in the day.

The thinking is if big time and famous investors jump on the bandwagon, how could it go wrong? The answer is it can go very wrong very fast.

Take crypto for example. When Blackstone, one of the biggest investment firms in the world, threw its weight behind crypto, it was hard for the average investor to talk themselves out of jumping into the fray. But, what was once thought of as “can’t miss” came crashing down in a hurry with prices slashed to a mere fraction of record highs with even high profile exchanges like FTX going out of business.

Thanks to the modern connected age, the madness of crowds is only compounding. And it’s not just finances in which crowd behavior is infecting behavior; it’s social behavior where crowds on social media gather to bully and cancel those with whom they disagree. Following the herd is reaching the point where it is becoming ill-advised and downright dangerous.

The madness of crowds is not a new phenomenon. Psychologists have been writing about it since the 19th century.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds while they only recover their senses slowly and one by one.” -Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds, 1841.

Mackay’s observations of herd behavior touched on social and economic phenomena in his book. One such economic example was the Dutch tulip mania. According to Mackay, speculators from all walks of life bought and sold tulip bulbs and even futures contracts on them during this bubble. Allegedly, some tulip bulb varieties briefly became the most expensive objects in the world during 1637 for no rhyme or reason other than collective madness.

The mass delusion was the only explanation for the tulip bubble, but it wasn’t an isolated case, as this type of collective madness in the markets continues to this day. It was the case with the dotcoms, mortgage-backed securities, and most recently with meme stocks and crypto.

One of the interesting insights that Mackay offered into the tulip madness is that it spared nobody. People of every class and walk of life got suckered into the madness. Sounds like the recent crypto craze.

If even prominent business, technology, financial, and government leaders get swept up in the madness, it’s hard to fault the average investor. But here’s the sad reality. Crypto will not be the last bubble or example of collective madness we’ll see in the markets. Something shiny and new will come down the pipeline eventually.

So the question is, how do investors protect themselves from the madness of the crowds?

One way is to not be afraid to question the crowd. Don’t be afraid to resist the pressure of your peers, family, coworkers, etc. Don’t be afraid to question the viability of a trend.

Two, stick to tried and true investments. Two traits the most recent bubbles have all had in common are that they were all speculative and relatively new asset classes. Dotcoms, securities backed by subprime mortgages, and crypto were all speculative and new. So, in the future, if you see a relatively new and speculative asset class taking off because of the madness of the crowds, be very leery.

How do smart investors avoid the madness of the crowds?

They embrace the boring. Savvy investors stick to tried and true assets that have withstood the test of time – unlike dotcoms, mortgage-backed securities, and crypto. They embrace asset classes like commercial real estate uncorrelated to Wall Street and insulated from herd behavior because of its illiquidity.

The dramatic volatility that plagues stocks and crypto because of herd behavior enabled by ultra-liquidity doesn’t affect real estate values. Besides, CRE is uncorrelated to Wall Street and can generate cash flow that keeps up with or even exceeds inflation.

Don’t follow the crowds and stick to a bubble bound to burst. Now is the time to protect your portfolio; it all starts with ignoring the herd.