The economy is trending backward, and things can get even scarier. As if pandemic, inflation, and war hadn’t already taken their toll on Americans’ pocketbooks, the latest layoff trends could make even more dents. But the big question is: are you prepared? Are you protected in the case of job loss? Are you prepared for a downturn?

Did you know that Forbes.com has a layoff tracker? Here is where you’ll find the latest news of the biggest layoffs in Corporate America.

According to the tracker and the latest numbers, 136,000 employees were cut in major U.S. layoffs over the first three months of 2023 – more than the previous two fiscal quarters combined, led by massive headcount reductions at Amazon, Google, Meta, and Microsoft.

Here are some of the biggest layoffs that made headlines in recent weeks:

April 27 –

Lyft unveiled plans to slash nearly 1,100 positions just weeks after confirming a round of layoffs in a blog post and nearly six months after 700 people were laid off from the company.

Vice Media’s layoffs could affect over 100 of the outlet’s roughly 1,500 employees.

Dropbox’s layoffs will affect roughly 16% of the tech giant’s staff.

Gap will cut roughly 1,800 corporate employees as part of a restructuring plan that will cost the company between $100 million and $120 million, following an initial round of job cuts in September that affected more than 500 corporate positions.

April 26 –

Tyson Foods’ layoffs will affect roughly 15% of senior leadership positions and 10% of the company’s roughly 6,000 corporate jobs just over a month after the company announced plans to shut two plants in Arkansas and Virginia and cut another 1,660 employees.

April 25 –

3M, the manufacturing giant known for its post-it notes and scotch tape, announced it was cutting 6,000 manufacturing jobs to cut annual costs, just months after the company cut 2,500 positions in January.

April 24 –

Disney began laying off another group of employees this week, bringing the total number of cuts this year to 4,000 as part of the company’s plan to cut 7,000 positions.

Red Hat, a Raleigh, North Carolina-based software manufacturer, started cutting 4% of its workforce.

April 21 –

Deloitte will cut 1,200 of its more than 156,000 jobs in its U.S. workforce.

April 20 –

Whole Foods plans to cut several hundred corporate jobs.

April 19 –

Meta informed employees of plans to cut roughly 4,000 employees – part of the company’s latest round of layoffs. Zuckerberg unveiled it last month, affecting approximately 10,000 of its nearly 87,000 employees and bringing Meta’s total number of job cuts since November to 21,000.

And the list goes on and on…

Things are obviously not well with the economy, but you don’t have to fall victim to whatever the next downturn brings. You may be asking yourself how you’ll be able to cover your expenses if a nasty recession comes along or how long your savings will last in such a perilous time.

Protecting yourself and your income during the next recession will take doing and not just thinking. In uncertain and difficult financial times, smart investors turn to alternative assets for protection – protection from job loss, loss of income, and depletion of savings. Just as food and water are essential in a natural disaster, passive income and capital preservation are essential in a financial disaster.

And to protect income and capital, smart investors gravitate towards cash-flowing alternative investments like private company investments (private equity) and real estate – assets backed by a tangible asset.

It’s not a surprise that the ultra-wealthy gravitate towards alternatives and that there’s a correlation between allocations to alternatives and an individual’s level of wealth. The high net worth (HNW) and ultrahigh net worth (UHNW) individuals are wealthy because they allocate far more alternatives to their portfolios than average or less affluent investors.

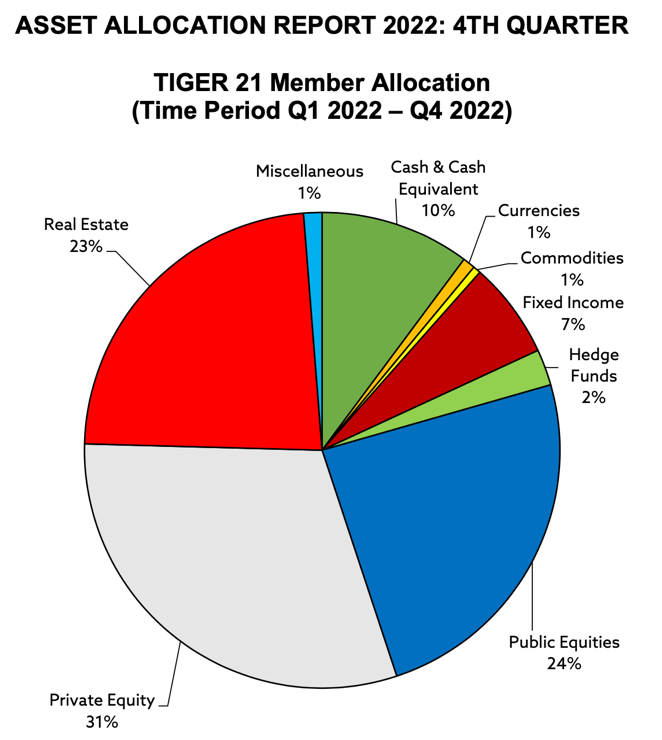

Check out the latest asset allocation report from one of those such groups of affluent investors:

For the unfamiliar, Tiger 21 is a peer-to-peer investing network consisting of ultra-high-net-worth investors from Europe and North America who must show $50 million in investable assets to join. The members of Tiger 21 consistently allocate 50% or more of their portfolios to two specific alternative assets: commercial real estate and private equity.

Besides the ability to earn higher risk-adjusted returns, the ultra-wealthy turn to alternatives for their sheltering qualities during downturns and inflationary times – including the ability to shelter and protect income and preserve capital.

The value of alternatives like commercial real estate and private equity is undeniable. Still, where private alternatives shine is the ability to generate multiple streams of income through them by teaming up with seasoned teams and experts who do all the heavy lifting, but that allows you to build recession-proof income and inflation-insulated growth.

A storm is coming. Are you prepared? How will you protect cash flow in the face of job loss or job reduction?

The answer might be private alternative investments backed by hard assets that cash flow and appreciate – even in hard times.

The ideal alternative asset generates income and growth that can keep pace with or even exceed inflation. Private alternatives like commercial real estate and private equity seem to fit the bill for smart investors.