Conventional wisdom says the average American needs at least $1 million for retirement. However, most Americans don’t nearly have nearly that amount for retirement. According to at least one source, as many as “80% of U.S. pre-retiree households are financially unprepared for a secure retirement.”

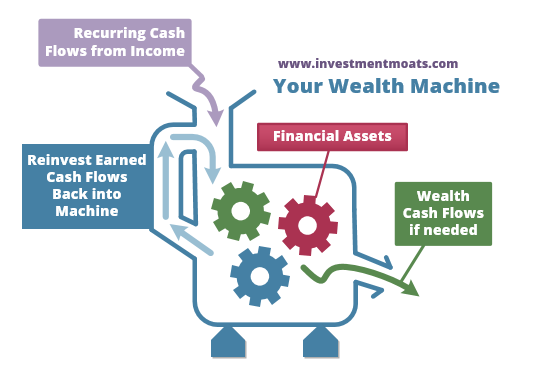

There are many reasons for the unpreparedness of Americans for the golden years, including poor planning and lack of education, but the biggest threat to retirement is bad debt. Think of your retirement as a machine where your wealth is grown. The process for growing that wealth might look something like the machine below. The bigger the machine, the greater your wealth and the more prepared you’ll be for retirement:

The key to growing wealth is relatively simple. You plug cash from your income (purple graphic above) into your machine to acquire financial assets (red asset) that generate cash flow. This cash flow can be reinvested (blue graphic) to feed the machine to grow your portfolio of financial assets to grow your wealth.

The problem with bad debt is that it prevents you from putting any money into the wealth machine to acquire cash-flowing assets, the kind required to produce income that can be reinvested to accelerate wealth exponentially.

Need proof that bad debt is the single biggest threat to retirement?

Check out the latest headlines:

Millennials are sinking under the weight of their debts, adding a record $3.8 trillion to the pile at the end of 2022. –finance.yahoo.com.

Credit card debt is at an all-time high, putting households near ‘breaking point,’ study shows. –cnbc.com.

People who acquire tons of bad debt have it all wrong.

They want to live the good life now, compromising their future prospects. Credit card debt used to acquire toys and non-productive things only drain disposable income as interest payments take away from the capital that can be invested into the wealth machine.

Consumers easily fall for the bad debt temptation because they’re lured into “living their best life now,” as social media touts. Though stimulating at first, it doesn’t take long for bad debt to squeeze finances in the short-term and wreck retirements in the long run.

The problem with bad debt is it will wreck the wealth machine. Without producing cash-flowing assets to keep the machine well-oiled and running, the wealth machine will grind to a halt and break down just like every other neglected machine.

Bad debt not only drains capital in the form of interest payments, but many things bought with bad debt require upkeep, which is another drain on your finances. Things like cars, toys, and recreational equipment require continual maintenance that is a constant drain on your pocketbook.

The middle class is plagued by bad debt, and it’s the single biggest retirement killer.

So what is the solution to breaking from the chains of bad debt? Debt.

Debt may be the solution to breaking the vicious cycle of bad debt. You’re probably scratching your head, but there’s a type of debt that can be leveraged for good and to build wealth instead of tearing it down.

Good debt in the form of real estate loans used to acquire cash-flowing investment properties is a strategy used by savvy investors for years to feed the wealth machine. So, instead of just acquiring financial assets with income from a job, that income can be used to obtain debt to multiply the capital available for acquiring cash-flowing assets.

So, instead of taking $100,000 to acquire assets for cash, this $100,000 can be used as a down payment to obtain a real estate loan to acquire one or more assets at 4-5 times ($400,000 to $500,000) the value of your starting capital (based on 20%-25% down payment requirement).

Of course, there’s a cost to taking out real estate loans. Nothing is free but even when taking into account debt servicing, the benefits far outweigh the costs.

For example, taking out a commercial loan charging interest of around 8% to acquire an apartment building that produces income well over the interest charged is debt worth undertaking because funds used to repay interest and principal come from the investment. In other words, it’s the tenants of your commercial properties that are essentially paying the costs of the loan – a loan that was used to acquire to produce this cash flow.

Using good debt, like real estate loans, can quickly neutralize the effects of bad debt because of its multiplying power. Two income streams can turn into four, then eight, and so on, until your wealth machine becomes a multi-generational wealth machine capable of not only allowing you to retire early but providing for multiple generations.

Fight the bad debt retirement killer with the good debt retirement savior.