Many investors vested in Wall Street are pondering how to recover from 2022 losses. Thanks to inflation, war, gas prices, and a recession, it’s been an ugly, bumpy ride on Wall Street this year. Year-to-date, the Dow is down more than 17%.

Traditionally, the 60/40 portfolio has been the most common portfolio allocation strategy, with 60% allocated to stocks and 40% allocated to bonds. The conventional wisdom was that fixed-income products like treasuries and corporate bonds would pick up the slack when stocks underperformed.

This strategy was fine and sound in the 80s, where bonds paid better than 12% during downturns, but those rates have been nowhere to be seen since the 80s. With the 10-year treasury currently hovering around 4.23% and corporate bonds on Wall Street from big issuers like Blackrock paying no better than 5%, fixed income during this downturn is a losing strategy, with inflation running around 8.1% (September).

That’s an annual loss of -3.1 based on the best-case scenario. So, the go-to Wall Street strategy of relying on bonds and fixed income during a downturn is a loser in the current environment.

What about sidelining your cash?

That’s an even worse idea. What some investors perceive as avoiding losses isn’t avoiding losses at all. Factoring in inflation, putting money under the mattress erodes your portfolio at -8.1% a year.

So fixed income and sidelining cash are out of the picture. Another option is to roll the dice and keep playing the Wall Street game. Wise decision? Not if some of the Wall Street naysayers are right. Some analysts believe the stock market could lose another 15%.

Factoring in the 17% losses year-to-date, another slide of 15% could dig investors a hole extremely tough to dig out of – bigger than investors think. Most investors would think that if their portfolios shed 32% of value, the market would only have to rebound 32% to get back to zero. Right? Wrong.

Here’s how:

Digging out of losses is not a one-to-one proposition. That’s because when you shed 32%, you start at a much lower base and will require gains exceeding the original loss to be made whole.

For example, if you started the year with $100k in your portfolio, and let’s say you stayed in the market and your portfolio ended up shedding 32%, you will need gains exceeding 32% to get back to ground zero. That’s because once you lose 32%, you now only have $68k to work with.

A 32% gain on $68k only puts you at $89,760. In order to get back to $100,000, your portfolio would have to gain 47%. That’s a tall order considering what happened in the aftermath of the Financial Crisis in 2008.

In 2008, it only took months for the stock market to shed 50% of its value following the whole debacle surrounding mortgage-backed securities and the real estate crash. It took seven years for the market to recover. Do you want to wait seven years to return to where you started?

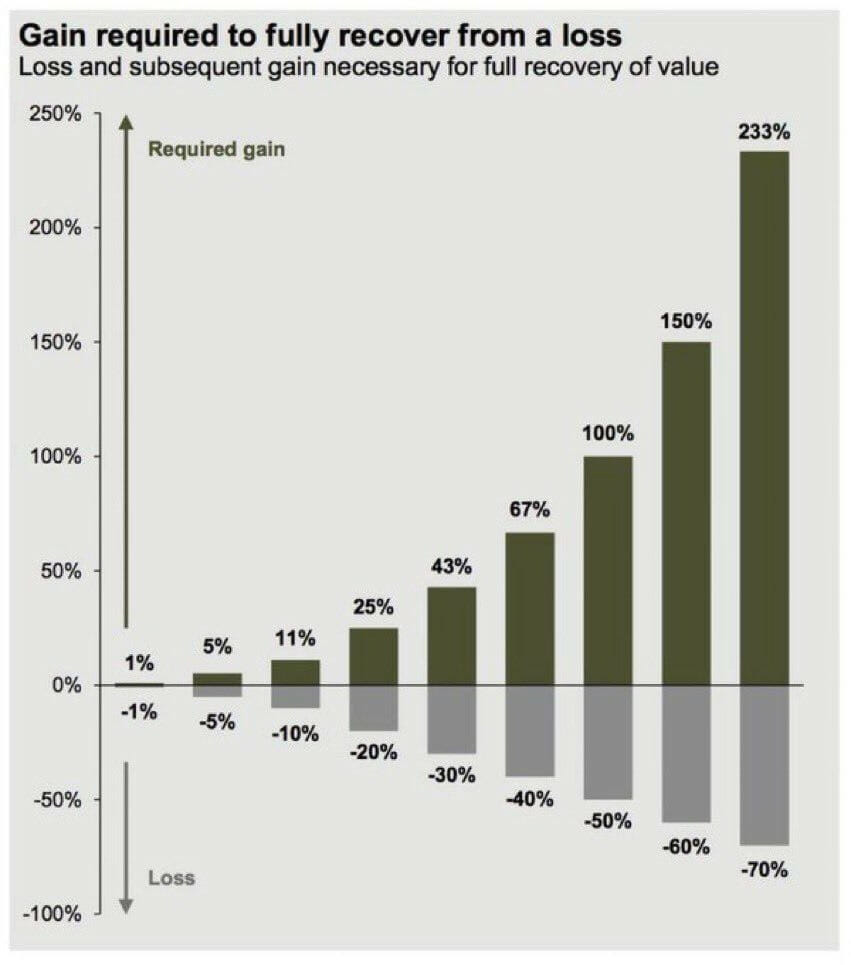

Here’s another problem with recovering from losses. The steeper the loss, the more exponentially difficult it is to climb out of the loss, as illustrated by the following chart:

This chart provides a sliding scale of what your portfolio will need to gain to get back to ground zero after a certain percentage loss. Going from a 30% to 40% loss will require an additional 22% of the gains needed to recover, but if you let it go to a loss of 50%, you will need an additional 33% to recover, and it only gets worse from there. The lesson is that the longer you stay in, the deeper the hole will be for you to climb out.

Here’s a twist to the recovering from losses dilemma. During a downturn, investors often have to dip into their portfolios to make ends meet.

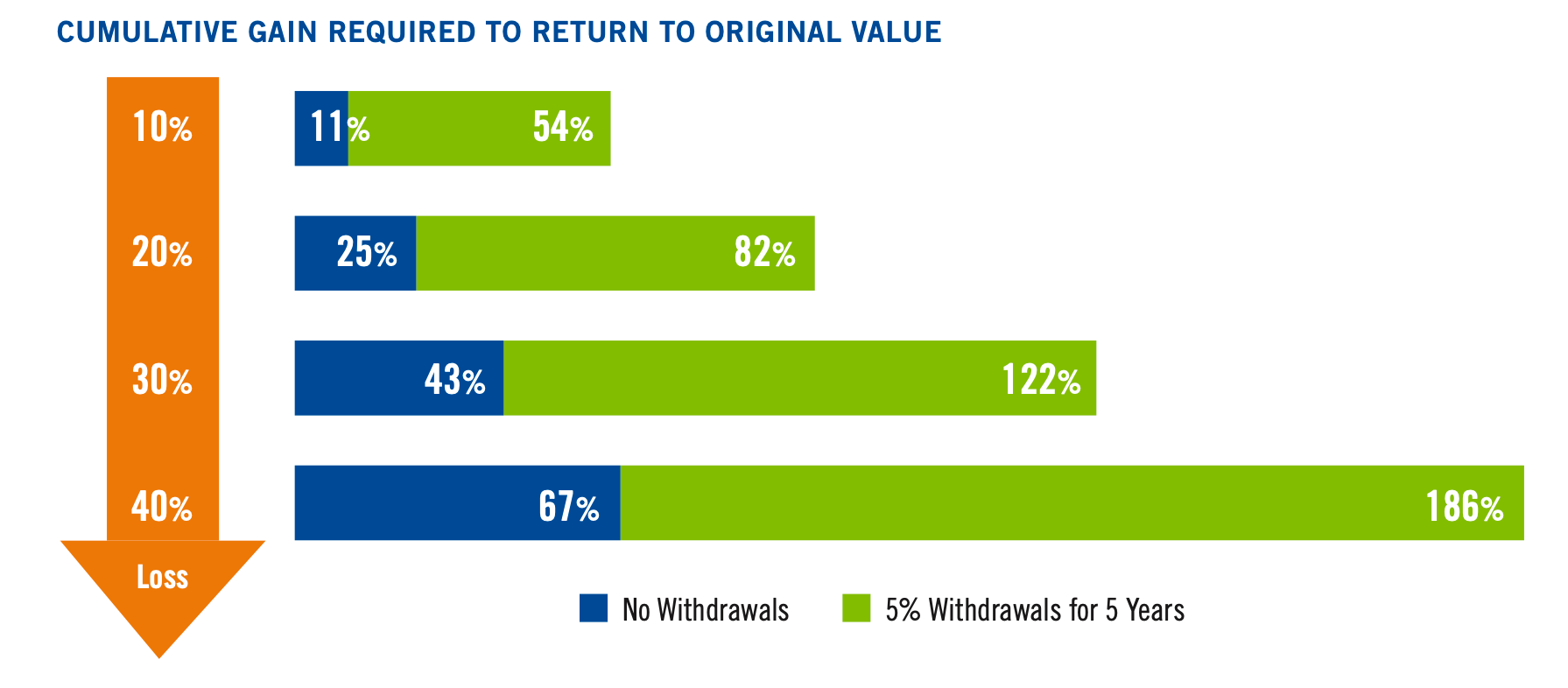

If you’re one of these investors, the road to recovery is even steeper, as illustrated by the chart below:

Suppose you withdraw a conservative average of 5% of your portfolio every year for five years. In that case, the chart above illustrates the pain of recovering from losses when taking withdrawals into account. Instead of needing to gain 43% to recover from a loss of 30%, it will now take 122% to recover from the same loss.

So far, none of the strategies for dealing with a downturn makes sense. Staying in and watching your portfolio continue to slide creates an exponentially bigger hole to dig out of. Fixed income and sidelining cash also don’t work. What if there was another option?

There is… and savvy investors have relied on this strategy for decades to insulate themselves from inflation and recession.

How do they do it?

Savvy investors don’t continue to take losses or sideline their cash. They tackle the problem head-on to profit from an uncertain economic environment. Instead of continuing a slide or sidelining their cash, they allocate to assets that thrive in this economic environment. Their assets of choice aren’t found on Wall Street but in the private markets – insulated from Wall Street volatility.

They seek long-term tangible and cash-flowing assets with a history of performing through recession and inflation. Certain segments of commercial real estate and income-producing businesses that provide essential goods and services are prime examples of inflation and recession-proof assets.

If you’re vested in Wall Street, rethink your recovery strategy.

Think outside the Wall Street box. In the process, you might avoid the painful road of recovering from losses and thriving in a downturn for private alternative assets.